4 Tips to Prepare for the Future of Statutory Reporting

In early 2020, we polled companies from around the world to provide you with insight into the current state of statutory reporting. We discovered that the legal entity reporting process for many companies is overwhelmingly manual, it is decentralised and many companies had real concerns about the accuracy and consistency of their data.

Based on these findings, we wanted to learn more. What challenges and priorities are now shaping the future of global statutory reporting? Over 300 multinational companies shared their insight into where they see their legal entity reporting processes headed over the next 12–18 months.

Here are four key findings from the survey, in addition to ways your company can address the issues plaguing this process.

1. Data is king

The greatest statutory accounting challenge facing companies is data management. This is a massive issue because true financial transformation first requires complete trust in data—transparency in where it came from, context into why it changed and control over how it is handled.

Our tip: Connect your data directly from your system of record to your system of work, and you will gain unparalleled data assurance and powerful new reporting abilities. When you have complete trust in your data, it will not only help you maintain compliance in complex environments but also help you make better business decisions.

2. Lack of control and oversight

In our last survey, we learned that 75% of respondents still use traditional word processing spreadsheets in their legal entity reporting process. With this in mind, it’s no wonder that the second greatest challenge for companies is the tracking and oversight of the global statutory reporting process.

Our tip: CFOs and controllers should leverage a cloud-based platform to centrally manage multiple jurisdiction statutory reporting and actively oversee the process going forward. A cloud-based platform offers ease of access for your staff—whether they are working in the same location or remote—and provides transparency into the tracking and review process with internal and external stakeholders (for example, your tax or audit team).

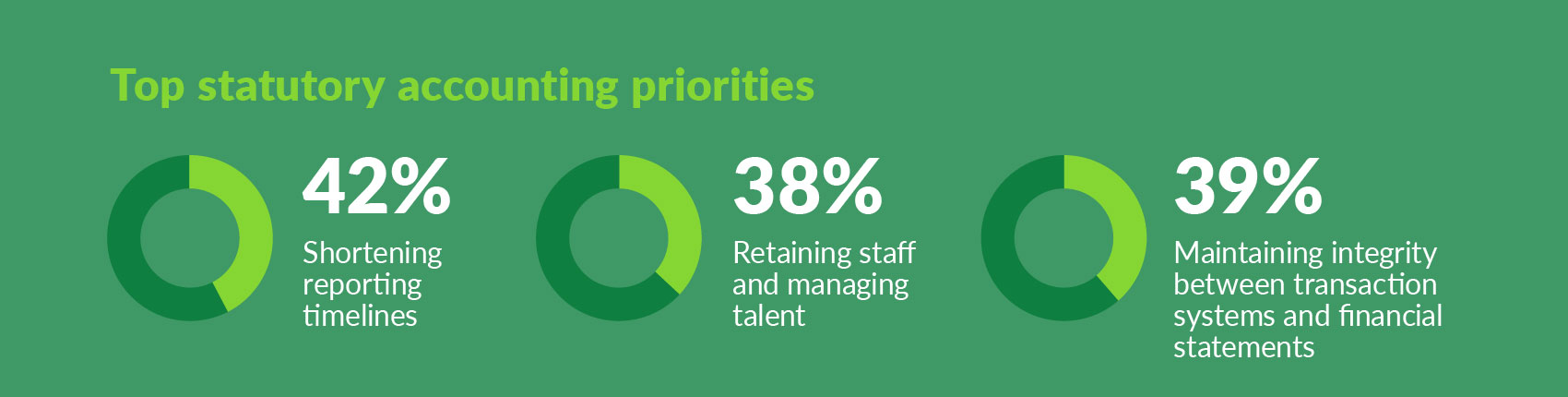

3. Top priority? Shortening reporting timelines

The first area of focus for the legal entity reporting process is to shorten reporting timelines. Many companies already have tight reporting timelines, and it can be difficult to incorporate changes to numbers, manage comments and maintain all these changes while still producing a document within a strict timeframe.

Our tip: Check out this video to see how one of the world’s largest mining companies used Workiva to save time and reduce the stress involved in statutory reporting.

4. The war for talent

It’s clear that the competition to attract and retain top finance and accounting talent continues to be fierce. Retaining, hiring and training staff was listed as the biggest area of cost investment while also being listed as one of the top three priorities over the next 12–18 months.

Our tip: Provide more opportunities for your staff to make an impact, rather than having them spend the majority of their time on tedious tasks, such as reformatting documents. You can start by reducing manual touch points in your statutory process (for example, by automating data refreshes).

Download the infographic to see more results from the survey and to gain insight into how companies are preparing for the future of global statutory reporting.

Preparing for the Future of Global Statutory Reporting

See the priorities shaping the future of global statutory reporting.