Leitfaden zur Finanzautomatisierung für Controller*innen

In diesem Leitfaden

According to a survey conducted by Deloitte's Center for Controllership and the Institute of Management Accountants (IMA),* 65% of respondents in finance and accounting say their organisations' controllership function is either unprepared or only somewhat prepared to meet future demands. In this guide, we’ll cover how to identify key areas of weakness throughout your financial reporting processes, and how and when these can be addressed using automation in accounting and finance to help you arm your organisation, including your board and executive team, for the future.

Who is the financial controller: the financial compass of the company

As a financial controller, you operate at the center of a high-performing reporting function with one eye on financial operations, ensuring regulatory adherence, and the other providing strategic financial insights that empower informed decision-making. You act as the lynchpin between multiple internal stakeholders from FP&A, internal audit, and general counsel, all the way to the CFO. This comes with a unique set of responsibilities—and risks:

Bereitstellung von genauen Finanzdaten

As a controller, credibility is king. As such, your first priority is to ensure the financial data and related financial insights you provide are accurate and reliable. This includes meticulously examining financial statements, transaction records, and other relevant documents.

Leading the financial reporting cycle

Being at the core of the financial reporting cycle, financial controllers must ensure their internal processes remain as efficient and pain-free as possible. Tackling inefficiencies while mitigating the risk of burnout in your team is key to keeping this well-oiled machine going smoothly.

Hochwertige Geschäftseinblicke liefern

It’s not just about the numbers. It’s also about the financial story they tell. The insights you provide regarding the financial performance of the business directly inform strategic direction. When done well, this can help you take the next steps in your career—but rushed insights based on inaccurate data can be devastating to your organisation.

A recent Workiva survey** revealed that minimising risk, protecting data integrity, and ensuring efficiency are the three top concerns for finance professionals.

Von den wichtigsten Prioritäten bis zum Druck von außen

Während diese Prioritäten unverändert bleiben, sieht Ihre Rolle als Finanzcontroller wahrscheinlich ganz anders aus als früher. Die Erwartungen an die Fluglotsen steigen. Tatsächlich sind 80% der von Deloitte und der IMA befragten Controller der Meinung, dass ihre Arbeit vorausschauender und analytischer geworden ist.* Der Grund dafür ist ein sich schnell entwickelnder Hintergrund:

Wirtschaftliche Volatilität

Between volatile markets and an unstable socio-political landscape, there’s more pressure than ever to arm your company with regular, accurate financial insights that enable agile decision-making. Cash flow might also be tighter, so it’s likely you’re being asked to do more with less.

Regulatorische Anforderungen

New regulations are coming in and shaking things up. The information contained in financial reports is being scrutinised more closely, heightening the need for traceable data. Integrated sustainability and financial reporting requirements mean that more data needs to be reported on and verified. For you, this means keeping the ship steady as your team adapts to new requirements while mitigating risk by continuing to ensure accuracy across everything you report.

Schwierigkeiten bei der Personalbesetzung

Talent shortages and the rise of remote work have transformed the way accounting, finance, and sustainability teams operate. While businesses strive to break down silos, departments remain disconnected and overstretched, using inefficient systems and outdated tools. Finance controllers are grappling with overstretched processes and staff burnouts making team productivity and satisfaction more of a challenge than ever before.

Warum sollten Sie Finanzprozesse automatisieren?

Eliminate costly processes

Working in this risky, high-pressure environment, you know firsthand that significant changes are necessary—but you’re also being asked to do more with smaller budgets and sometimes even a smaller team. Hiring new staff may not be an option at present, let alone embarking on a full overhaul of existing financial processes, structures, and tools.

Accelerate financial processes

Faced with these challenges, many finance teams find themselves turning to modern, cloud-based finance process automation solutions that promise measurable benefits without the disruption, expense, or risk of a full overhaul. From accounting to financial planning, finance process automation solutions can automate repetitive manual tasks, strengthen data accuracy and consistency, and help improve the quality of insights.

Improve regulatory compliance

In many cases, the slightest deviation from compliance norms can have far-reaching consequences. Utilising finance process automation helps enforce consistent processes and reduce the likelihood of non-compliance due to human errors. This is especially crucial in industries such as banking, insurance, and energy & utilities—with strict financial regulations.

Choosing the right finance automation tool

Aber wie wählen Sie bei so vielen Tools und Plattformen die richtige(n) für Ihr Team aus? Lesen Sie weiter für unsere 3 Schritte für eine erfolgreiche digitale Transformation.

Schritt 1: Stellen Sie fest, wo finanzielle Automatisierung erforderlich ist

As pressures mount, it can be tempting to tackle financial process challenges on a case-by-case basis. Unfortunately, this can lead to a disconnected set of short-term solutions that work only until the next problem arises.

Being prepared for the long term requires a more strategic approach. To find out where you could benefit the most from accounting and finance automation, start by mapping out strengths and weaknesses across your three key priorities—your insights, your data, and your teams.

Insight considerations for the controller

Data story-telling is instrumental in helping steer business decisions. Start by considering the value your financial insights hold for your CFO in the context of board and executive reporting. How has this changed in recent years? Make a list of the shareholder expectations and regulations guiding what needs to be reported on, noting the main areas that are currently evolving.

Als Nächstes sollten Sie überlegen, wie schnell Sie diese Erkenntnisse liefern können. Wenn Ihr CFO Sie um eine bestimmte Zahl bittet, wie schnell können Sie sie liefern? Notieren Sie sich, welche Informationen Sie schnell bereitstellen oder überprüfen können und welche Daten schwieriger oder langsamer zugänglich sind.

Um qualitativ hochwertige Einblicke zu liefern, sind zwei Dinge erforderlich: Vertrauen in die Genauigkeit Ihrer Daten und genügend Zeit, um tief in Ihre Analyse einzutauchen und proaktiv Fragen und Bedenken zu antizipieren. Heben Sie hervor, in welchen Bereichen Sie sich sicher fühlen und in welchen weniger sicher, was Geschwindigkeit, Genauigkeit und Tiefe angeht. Dies wird Ihnen helfen, die Bereiche in Ihrem Prozess zu erkennen, die mit der Automatisierung von Finanzprozessen angegangen werden könnten.

Data considerations

As controllers are being made responsible for more financial and non-financial data than ever, it’s essential for you to have a clear view of where all your information originates. Your data points are most likely generated from multiple systems, including enterprise resource planning (ERP), business intelligence (BI), and enterprise performance management (EPM) platforms. Map out how and where your data is gathered and what financial planning, tracking, and reporting software is being used.

Continue building your map of financial data by following individual data points along their journey from the point of origin to the final report. Make note of all the different teams, systems, and processes a single data point encounters.

As you map out your data journeys, make note of the controls and processes that ensure information remains accurate and unchanged. How is data verified at source? What finance controls are in place as it passes from one team or software to the next? Consider whether information is being passed along manually (e.g., by copy/pasting) or automatically, and who is in charge of transferring, amending, and verifying figures.

Team considerations

As stakeholders demand more financial and non-financial insights, it’s likely that you’re working across more teams than you may even realise. As you map out your data journeys, compile an inventory of everyone involved in the financial reporting process and what roles they have, from input providers (e.g., FP&A, tax) to report creators (e.g., corporate accounting), to reviewers (e.g., executives, department leads).

Überlegen Sie bei der Zusammenstellung Ihrer Teams, wie sie zusammenarbeiten. Achten Sie darauf, wie Bearbeitungen vorgenommen werden, wie Kommentare ausgetauscht werden, wo die Mitarbeiter in Echtzeit zusammenarbeiten können und wo sie einzelne Dokumentversionen weitergeben (z.B. per E-Mail oder Ausdruck). Wie effizient, schnell und nachvollziehbar ist die Kommunikation bei jedem Schritt? Überlegen Sie, wie das innerhalb und zwischen verschiedenen Teams funktioniert.

Examining these different team processes should start to give you a clear picture of where the main inefficiencies and areas of weakness lie. Taking this information into account, ask your financial reporting team what their biggest frustrations are, what their most time-consuming tasks currently are, and what they feel they should be spending more time on.

Schritt 2: Erkennen Sie die Anzeichen einer starken Lösung

Answering the above questions in detail will help you highlight and connect underlying issues in your financial reporting process and identify which areas are in most need of addressing with financial process automation.

Your individual ERP systems may be very effective however, inefficiencies and risks can often arise as data travels between different systems and teams. Automating finance processes from beginning to end can alleviate any discrepancies that may arise between ERP systems. Having identified areas in which finance automation can be most strategically deployed, what are the key indicators of a robust finance automation solution?

Must-haves in finance automation solutions

Laut unserer Umfrage** planen 51% der Unternehmen, mehr für die Umgestaltung ihrer Finanzen auszugeben. Schauen Sie sich an, wo derzeit Investitionen getätigt werden - welche übergreifenden Probleme sollen damit gelöst werden? Ziel ist es, die bestehenden Investitionsbereiche zu nutzen und auszubauen.

Überlegen Sie auch, welchen ROI Sie mit der Plattform zu erzielen hoffen, und finden Sie heraus, welchen ROI andere Unternehmen mit der Plattform erzielt haben. Starke Automatisierungslösungen für den Finanzbereich bieten potenziellen Kunden oft die Möglichkeit, sich mit ihren derzeitigen Nutzern auszutauschen, bevor sie sich festlegen.

Möchte ich ein aktuelles Problem lösen oder ein grundlegendes Problem angehen? Fragen Sie sich selbst:

- Wird diese Lösung zur Verbesserung der Datenqualität beitragen?

- Wird es die Effizienz des Teams unterstützen?

- Wird es meine Einsichten stärken?

If the answer is yes to any of these, the solution is more likely to have a long-lasting impact on your organisation. As the need to report on both financial and non-financial data increases, finding a financial process automation solution that unites disparate functions by impacting two or more of the above areas is key.

In the current landscape, lengthy implementation processes simply aren’t feasible. Modern, cloud-based financial automation solutions offer the option of a much faster adoption process. Look for automated financial reporting solutions that are designed to work with your existing tools, rather than simply adding to them, and that have a familiar user interface that will be easy for your team to adopt.

Step 3: Plan your finance automation implementation

According to a survey conducted by Deloitte’s Center for Controllership and the Institute of Management Accountants,* the biggest barriers to a successful transition to finance process automation include a lack of time, financial resources, capacity, and expertise in implementation. Of course, even the perfect tool won’t go far if the adoption phase isn’t thought through. Here are our top suggestions for a seamless implementation process:

Unsere Empfehlungen

Eine starke Lösung sollte zwar schnell zu implementieren sein, aber eine erfolgreiche Implementierung erfordert dennoch Planung und Sorgfalt. Wenn ein neues Tool während eines Berichtszyklus eingeführt wird, können Sie das alte und das neue System parallel laufen lassen, bevor Sie vollständig umstellen. Berücksichtigen Sie die Bedürfnisse aller Beteiligten und sorgen Sie dafür, dass alle genügend Zeit haben, um sich einzubringen.

Es ist wichtig, alle Hauptnutzer frühzeitig in den Entscheidungsprozess einzubeziehen, um ihre Bedürfnisse, Hindernisse und Vorbehalte vollständig zu verstehen. Ihre Teammitglieder verfügen möglicherweise über unterschiedliche Erfahrungen, Fähigkeiten und Selbstvertrauen, wenn es um Technologie geht. Interne Onboarding-Sitzungen können viel dazu beitragen, dass alle Mitarbeiter schneller mit der Arbeit beginnen können.

From decision-making to implementation, adopting the right tools can be all-consuming. Make sure you speak to solution experts who can guide you through the entire financial automation process, help you make the right choices for your team, and provide support along the way. Involving partners and experts from the very beginning can help maximise your ROI and help you see results more quickly.

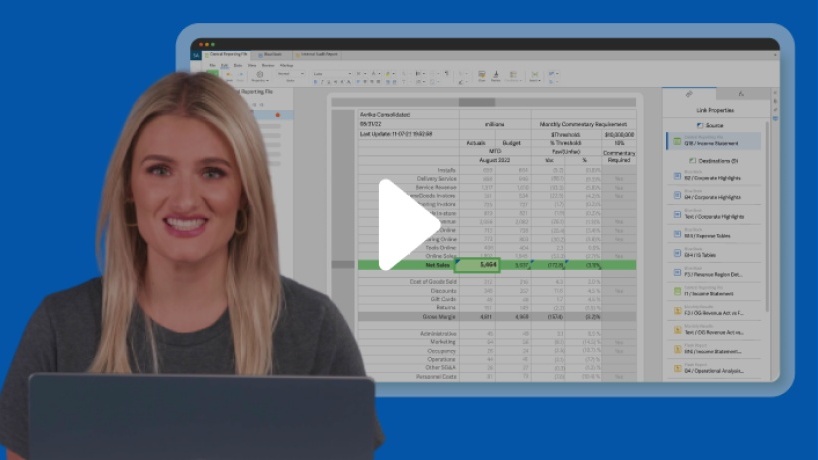

Wo Workiva ins Spiel kommt

Vertrauenswürdige, zugängliche Daten

Aggregating data from both systems and people? Across multiple places? We’ve got you covered—automate the collection of financial data and connect directly to your source systems with comprehensive finance automation.

Productive, happy reporting teams

Reduzieren Sie den Bedarf an zeitaufwändiger, risikoreicher manueller Dateneingabe dank der Finanzautomatisierungstechnologie. Erledigen Sie mehr Aufgaben mit größerer Sicherheit, während Sie in Echtzeit mit mehreren Teams auf unserer Cloud-Plattform arbeiten.

Deeper, accurate financial insights

Workiva’s finance automation platform connects information across multiple reports and presentations, helping your story stay consistent and up-to-date while giving you full oversight across multiple teams. With less time spent updating and verifying data points, you can focus on going deeper in your insights and providing them with more certainty.