Présentation de la directive CSRD

To many, the Corporate Sustainability Reporting Directive will be a game changer in ESG reporting. But what is it, who will it affect, and when does it come into force? This introductory guide breaks it all down.

De quoi s'agit-il ?

The Corporate Sustainability Reporting Directive (CSRD), sets out environmental, social and governance (ESG) reporting requirements for companies and aims to significantly expand the scope of the NFRD, both in terms of who needs to report and what needs to be reported.

First proposed in April 2021, this new European Union (EU) legislation developed by the European Financial Reporting Advisory Group (EFRAG) will gradually be coming into play over the next few years. It expands upon, and will replace, the Non-Financial Reporting Directive (NFRD), which has been in force since 2018.

What are the new CSRD requirements?

The new CSRD requirements introduce mandatory corporate sustainability reporting standards and the integration of ESG information in management and annual reports. This means mandatory assurance audits and digital tagging of information by the financial reporting team.

What is the scope of the CSRD?

All large companies(1) and all companies listed on regulated markets (except micro-enterprises) must comply with CSRD reporting requirements.

When is the CSRD mandated by?

The Corporate Sustainability Reporting Directive officially entered into force on 5 January 2023. A gradual rollout with the first companies due to file will occur in Q1 2025 (applies to FY 2024).

Frequently Asked CSRD Questions

The CSRD will affect all EU-based companies who have:

- Chiffre d'affaires net d'au moins 40 millions d'euros

- Au moins 20 millions d'euros d'actifs

- Plus de 250 employés

- Toutes les sociétés cotées (à l'exception des micro-entreprises) seront également concernées.

The CSRD, having a considerably larger reach than the NFRD, (up from 11,000 to around 50,000) also impacts non-EU companies who have with EU-based subsidiaries, or who have securities on EU-regulated markets, are also required to comply with the CSRD. This means, for example, that a UK or US-based multi-entity corporation with a single subsidiary in the EU will need to report in line with CSRD regulations, even if all their other subsidiaries are outside of the EU.

The European Sustainability Reporting Standards (ESRS) are standards being brought in by the CSRD to provide the specific requirements that companies will need to follow in their reporting practices.

En novembre 2022, l'EFRAG a publié la première série de projets d'ESRS, couvrant 12 normes. Ceux-ci couvrent

- General: 1- General requirements, 2- General disclosures

- Environnement : E1 - Changement climatique, E2 - Pollution, E3 - Eau et ressources marines, E4 - Biodiversité et écosystèmes, E5 - Utilisation des ressources et économie circulaire

- Social: S1 - Own Workforce, S2- Workers in the value chain, S3 - Affected communities, S4 - Consumers and end users

- Governance: G1 - Business Conduct

While reporting in line with E2 - General disclosures and E1 - Climate change is required for all companies in scope of the CSRD, not all of these are mandatory for every company. EFRAG and the ESRS provide detailed information on who needs to follow which specific reporting standards.

The CSRD aims to establish a shared framework for reporting non-financial data. The idea is that by enforcing thorough, robust, standardized reports, everyone— from policymakers and investors to clients and consumers—can make informed decisions on a company’s ESG performance.

L’UE estime depuis longtemps que les investisseurs et le grand public ont le droit de comprendre l’impact ESG des entreprises de façon claire et facilement comparable. Bien que les réglementations actuelles (comme la NFRD) aient marqué une avancée en ce domaine, le consensus était qu'elles ne suffisaient pas.

Les investisseurs ont constaté que de nombreux rapports ESG omettaient des informations importantes ou utiles, utilisaient différents indicateurs et mettaient l'accent sur des domaines différents, d'où des problèmes de fiabilité des données ou de comparaison des entreprises. Comme l'a montré l'UE, cela peut nuire à l'investissement durable, l'un de ses objectifs majeurs.

L'un des principaux objectifs de la directive CSRD consiste à réunir les trois volets des rapports ESG de manière plus uniforme et cohérente. Les entreprises devront publier des informations concernant :

- L'environnement

- La gestion du personnel et l'approche des questions sociales

- Les droits de l'homme

- La lutte contre la corruption

- La diversité du conseil d'administration

Quand la CSRD entrera-t-elle en vigueur ?

The text of the CSRD was passed following a landslide vote in the European Parliament in November 2022 and officially entered into force in the EU in early January 2023. From this date, member states have 18 months to transpose the new standards into national law.

Each member state has its own history of regulations regarding environmental, social, and governance (ESG) reporting and is likely to implement the new requirements in its own way.

The CSRD will then be phased in from:

- FY’24: For all organizations that are already within the existing scope of the NFRD (currently around 11,700 organizations)

- FY’25: All “large” organizations—firms with a net turnover of €40 million or more, at least €20 million in assets, and 250+ employees

- Later: All listed companies, including listed small and medium-sized enterprises (SMEs) but with the exception of micro-enterprises

En quoi consisteront les exigences de reporting ?

Voici quelques-unes des caractéristiques remarquables du règlement :

- Double materiality: Organizations will need to disclose the company’s impact on social and environmental issues, known as double materiality, and how these issues will likely affect the business in the future.

- Looking both ahead and back: Companies will be required to furnish both retrospective and forward-looking analyses. This will mean sharing quantitative information (such as measured impact to date) and qualitative information (such as targets, strategy, and risk assessment).

- Stricter rules around climate-related disclosures: Most notably, the CSRD will call for disclosure of Scope 3 emissions. These are the indirect CO2 emissions produced by all other companies connected to the organization throughout the entire supply chain.

- Enforced audits: For the first time, all corporate sustainability reporting information must pass through an audit process to verify accuracy before publication.

Comment se présenteront les rapports CSRD ?

Companies will be expected to provide all CSRD-related information in either their annual or management reports. This is to ensure that financial and ESG information is published at the same time and considered as a whole, rather than two separate entities.

In line with ESEF regulations, all sustainability information will need to be provided in xHTML format for standardization and easier verification.

Comment la directive s’intègrera-t-elle aux autres réglementations ?

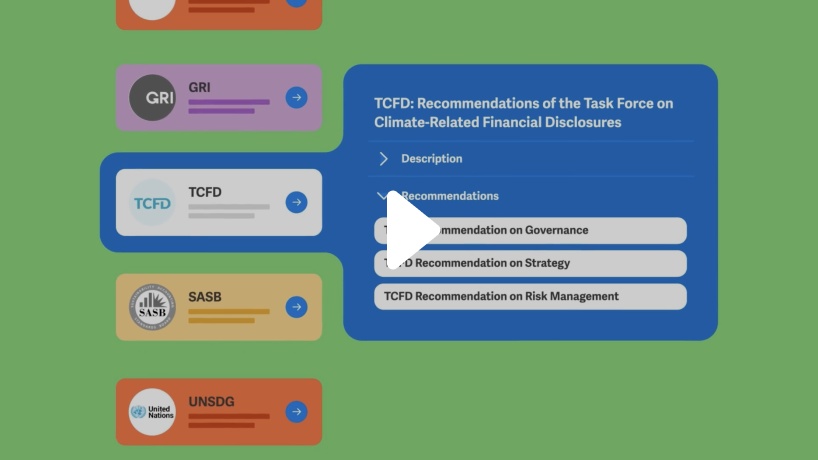

With so many different mandates and legislations, it can be challenging to grasp how they all fit in with one another. As mentioned previously, the CSRD and ESRS will expand upon and replace the Non-Financial Reporting Directive (NFRD).

Toutefois, la norme intègrera aussi des règlements existants de l’UE, notamment :

- The Sustainable Finance Disclosure Regulation (SFDR), which sets out ESG disclosure obligations for financial market participants

- Taxonomie de l’UE, qui désigne une classification des activités économiques durables sur le plan environnemental.

The CSRD, the SFDR, and the EU Taxonomy all work together to help promote sustainable investments. By bringing them together in a single bundle, the aim is to align requirements, help reduce complexity, and avoid the risk of duplicating reporting requirements.

Quels sont les défis posés par la publication CSRD ?

Because the CSRD requirements are far more detailed than those of the NFRD, companies will need to gather vast amounts of ESG data, which all need to be accurate and verifiable. Scope 3 emissions—which extend beyond a company’s direct CO2 output and look at everything from up and downstream transportation and distribution, to the use of sold products—are particularly difficult to track.

Les entreprises déclarant déjà dans le cadre de la NFRD devront donc passer par une longue phase d’apprentissage, tandis que celles qui doivent produire leur premier rapport ESG dans le cadre de la CSRD feront face à un défi encore plus grand.

Importantly, the CSRD is being incorporated into national law throughout the EU. Depending on how stringent individual countries choose to be regarding enforcement, non-compliance could lead to penalties or prosecution, potentially posing a serious business risk for organizations.

Résumé : un aperçu du CSRD

This guide distills key information about the mandate and how it will impact your organization.

Que dois-je savoir d’autre ?

The CSRD will be granting individual Member States the opportunity to open the market to ‘independent assurance services providers’. Countries that choose to take this option would allow assurance firms as well as auditors to verify the corporate sustainability reporting information provided.

In the future, smaller organizations will also need to report in accordance with the CSRD. Modified regulations tailored for SMEs will be published, and those listed on a regulated market will need to start reporting from 2028.

Nos recommandations

Tout le monde sur le pont

The CSRD is a substantial step up from previous ESG reporting standards. To meet these high CSRD standards, your company will need full engagement from all stakeholders, particularly C-level executives and the board of directors. More than putting together a report, the CSRD requires a clear vision and goal setting.

Préparez-vous dès maintenant

Now that we know exactly what the CSRD entails, it's time to make the necessary decisions to ensure that your organization complies with the mandate.

Rester agile

As the reporting landscape develops, it’s important to assess the processes and tools that underpin daily operations throughout the organization. Do you have access to all the data your organization may need to report on? How is it being gathered? Is it secure, verifiable, and connected? Having these building blocks in place (with the help of the right technology and processes) will prepare you for any upcoming CSRD reporting requirements.

More ESG and CSRD Resources

Our ESG solution has all CSRD reporting requirements built into the platform, which we continually optimize to enable its seamless integration within the reporting process. To help you stay ahead of evolving policies and legislation, our platform connects data across your entire organization and existing systems, all while maintaining control and mitigating risk.

La CSRD : faire tomber les barrières entre l'ESG et la finance

Reporting ESG 101 : Ce que vous devez savoir

Bilan de la CSRD : public concerné et comment s'y préparer | Workiva

Découvrez comment Workiva peut vous aider dans votre démarche de durabilité

Pour vous aider à garder une longueur d'avance sur l'évolution des législations, notre plateforme relie les données de l'ensemble de votre organisation et des systèmes existants, tout en maintenant le contrôle et en atténuant les risques. En vous permettant de faire confiance à vos données et de produire des rapports de manière transparente et vérifiable, Workiva vous permet d'aller au-delà de la conformité et de vous concentrer sur la communication - et la réalisation - des objectifs de votre entreprise.

Logiciel ESG

Notre solution ESG intègre toutes les exigences de reporting du CSRD, que nous optimisons en permanence pour permettre une intégration transparente dans le processus de reporting.

Vidéo de démonstration du GSE

Workiva se distingue des autres outils de reporting ESG en favorisant la collaboration entre les différentes équipes et en intégrant intelligemment les données pour garantir la transparence tout au long du processus de reporting.